What role will rental play in the energy transition?

24 October 2023

Ever expanding rental companies are using their purchasing power to invest in emissions-free construction equipment. But what future technologies are they willing to take a punt on - and can they pass on the costs of green machines to consumers? Murray Pollok reports

Last year, Sunbelt Rentals in the US said it was trialing the T7X electric compact tracked loaders from Bobcat as part of its push into low-carbon products. (Photo: Sunbelt Rentals)

Last year, Sunbelt Rentals in the US said it was trialing the T7X electric compact tracked loaders from Bobcat as part of its push into low-carbon products. (Photo: Sunbelt Rentals)

Equipment rental companies are getting bigger, and with that scale comes an equipment buying power that is both remarkable and significant.

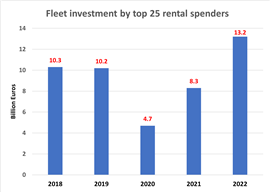

The top 25 rental spenders in 2022, for example, collectively invested more than €13 billion on new fleet in 2022.

The top five alone spent more than €7.5 million, with the two largest – Sunbelt Rentals and United Rentals – laying out around €2.4 billion and €3 billion, respectively.

Investment has recovered strongly post-pandemic and is now higher than the previous peaks of €10 billion in 2018 and 2019. (All of these figures are from the IRN100 listing of the world’s largest rental companies, compiled by International Rental News magazine.)

Equipment spending from the top 25 is at its highest in five years

Equipment spending from the top 25 is at its highest in five years

Spending levels rise and fall with business cycles – rental companies can turn off the tap and age their fleets in lean times – but the scale of spending by rental is here to stay.

Why is it significant? Because as these companies grow in size they will play a major role in the energy transition, both by offering contractors a source of low-carbon emission machines, and by using their purchasing power to encourage OEMs to accelerate their development of electric and other forms of cleaner machines.

This is a role that is clearly recognised by rental companies themselves. At the recent annual convention of the European Rental Association (ERA), held in Maastricht, Stephane Henon, President of the association and also managing director of Loxam – Europe’s biggest rental company – spoke about “the key role of rental in the green transition.”

Henon said he strongly believed that the transition “is a unique opportunity to increase penetration of rental, as most of our customers are keen on green alternatives but are reluctant to invest.

“With the support of the OEMs that are investing heavily in low emission technologies, the rental industry is at the forefront of the carbon footprint reduction on worksites.”

This transition is not straightforward, however, as many rental companies are finding out. As Henon said; “the price of green equipment is expensive, of course, and new technologies are not yet mature, which represents a risk for our companies to invest in such machines”.

The cost issue is important: electric equipment is expensive – sometimes double the price or more – and it is difficult for rental companies to charge significantly higher rental prices for a machine that does the same work (albeit with lower carbon emissions).

Writing in International Rental News recently, Andy Wright, CEO of Sunbelt Rentals UK, pointed out that rental companies are having to place bets on which of the new power technologies will be adopted; “Diesel, which most of the equipment in the sector runs on, is now seen as bad and numerous alternatives are being developed, from HVO, to electrification, to solar to hydrogen or some combination of them all.

“It’s not absolutely clear yet which new technology will win out to be the predominant one for the future, so that in itself is a major risk for rental companies as we decide which we should invest in.”

As Wright wrote, this all comes at a time when costs are already rising, with OEMs passing on price rises to buyers and other inflationary pressures.

For most rental companies, the answer is to focus on new forms of power where that is most easily achieved, in products such as aerial platforms, lighting towers and generators (where hybrid engine/battery units are now relatively common).

That alone can have a big impact. Netherlands-based Boels, for example, said in June that more than 80% of its rental fleet of 840,000 items is now electrically powered. Of course, high volume items such as scissor lifts have always been predominantly battery powered.

There are also cases where a rental company partners with an OEM for a specific product: a good example is UK rental company Speedy and its multi-million pound investment with access manufacturer Niftylift for a self-propelled aerial platform powered by a hydrogen fuel cell.

Rental companies are also investing in cleaner vehicles for their own delivery fleets, particularly those operating in urban areas. Avesco Rent in Switzerland found that cutting carbon emissions on its inter-depot transfers of equipment made a significant impact on its overall carbon emissions.

What is clear is that the rental industry can be instrumental in accelerating the energy transition, even if the process is complicated and sometimes painful.

And everybody in the supply chain will have to pay: OEMs in product development costs, rental companies in purchase prices; and – yes – contractors and other end users in higher rental rates.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM