Record-breaking year for equipment sales

26 April 2022

Global equipment sales hit a record high in 2021, and demand will remain strong as order backlogs are fulfilled. Beyond that, it is not clear what impact the war in Ukraine will have on inflationary pressures, writes the team at Off-Highway Research

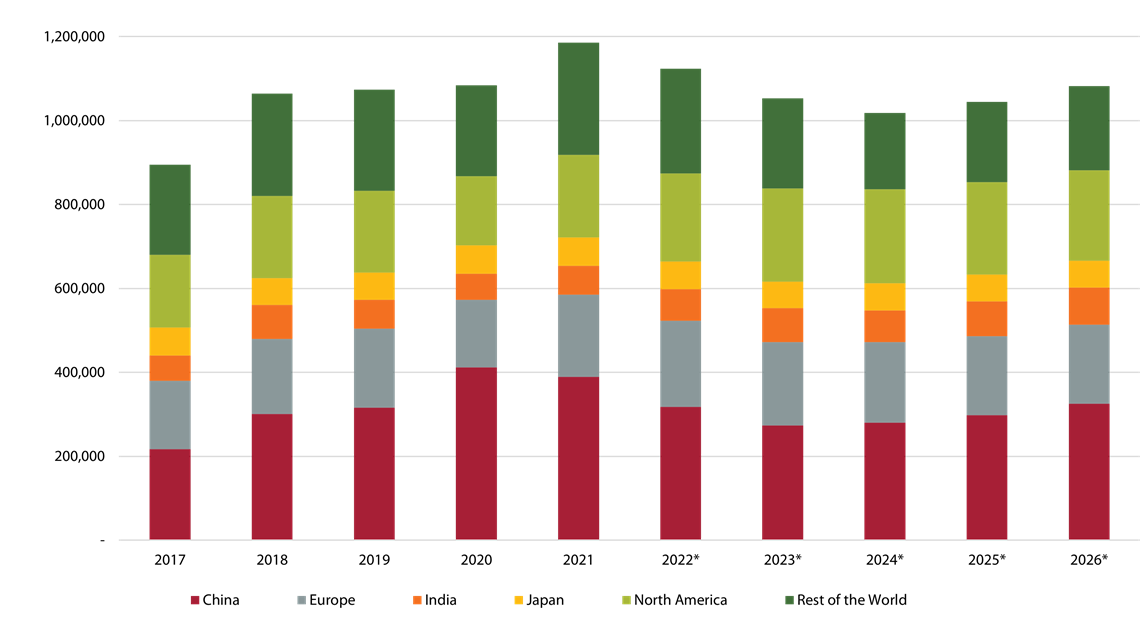

The rebound in global construction equipment sales, which began in the second half of 2020, continued almost unabated last year. As a result, a record of nearly 1.2 million pieces of construction equipment were sold around the world in 2021 – a 9% rise on the figure in 2020, which was impacted by the Covid pandemic.

The only major market to fall last year was China, which fell by 6% (Photo: AdobeStock)

The only major market to fall last year was China, which fell by 6% (Photo: AdobeStock)

The only major market to fall last year was China. After aggressive stimulus spending was put in place in March and April 2020, the market grew 30% that year to levels not seen since the (also stimulus-driven) boom of 2010-2011. However, by the second quarter of 2021 that impetus was spent, and sales in China started to decline sharply. The overall result was a 6% fall in equipment sales in China in 2021.

However, most other markets in the world had excellent years in 2021. The most striking improvements were in Europe and North America, which were up 22% and 19% respectively, while sales in India increased by 10%. Japan – normally a flat market – saw a modest rise of 1%.

Sales in the rest of the world, which is all the countries not explicitly named above (essentially emerging markets, excluding India and China) increased by 24%.

What has driven growth in equipment sales?

There were three fundamental drivers of growth in 2021. First, the extraordinarily low interest rates seen around the world since the start of the pandemic have been a strong positive for the residential building market. These have stimulated building by developers and encouraged homeowners to move to bigger properties or extend their existing houses – in many cases in response to the move to home working for many previously office-based jobs as a consequence of the pandemic.

The second driver has been stimulus spending and other infrastructure investment by governments around the world. Although it is debatable to what extent these plans contain genuinely new projects, and to what extent activity got underway in 2021, the announcement of plans alone has been enough to reassure contractors and rental companies that there is a reliable pipeline of work ahead. This, in turn, has given them confidence to invest in new equipment.

Sales in China are expected to drop in 2022 – but this is from a very high level (Photo: Off-Highway Research)

Sales in China are expected to drop in 2022 – but this is from a very high level (Photo: Off-Highway Research)

Third in the list of drivers are the high commodity prices which have developed over the last 12-18 months. These have been pushed to even greater levels by the economic fallout from Russa’s invasion of Ukraine. High prices encourage commodity producers to invest in their fleets – either to renew aging machines or to increase production and benefit from the higher prices for the materials they produce.

All these positives pushed demand for equipment beyond what could be met by the industry in 2021. In the second half of 2020, production of construction equipment was slow to restart due to component supply issues and the length and complexity of supply chains.

As has been widely reported, this problem was by no means limited to construction equipment – it was a phenomena that impacted almost all manufactured goods.

These problems were exacerbated by issues in the global shipping, transportation and logistics segment. Port capacity was limited in many parts of the world due to lockdowns and absenteeism due to Covid-related illness. In addition, several countries in the world have experienced bottlenecks as basic as not having enough truck drivers. This resulted in not only shipping delays, but a scarcity of shipping capacity, which pushed prices sharply upwards.

The problem is twofold. Manufacturers rely on transportation networks to deliver them the components they need to build products. They then need those same networks to get products to customers.

Again, this impacted on many types of manufactured goods, and the construction equipment segment was no exception. Lead times for new machines have become extremely long as a result, and prices are rising as manufacturers pass on their input cost increases to customers.

High equipment sales expected for European market

After the pronounced, stimulus-driven spike in sales in China in 2020 and 2021, the market will fall back over the course of 2022 and 2023 to more natural levels of around 300,000 units per year. Although this is a steep fall from 2020’s high of 412,000 unit sales, this represents a return to normal, rather than a worrying collapse.

The rebound in Europe in 2021 was much stronger than expected, and the industry was caught out by a lack of inventory (having sold this when the pandemic struck in 2020), combined with the delays and difficulties in sourcing an adequate supply of new machines.

Sales of construction equipment by region (Photo: Off-Highway Research)

Sales of construction equipment by region (Photo: Off-Highway Research)

The number of machines sold in 2021 in Europe was the second highest volume on record, with only 2007, the peak year of the booming 2000s, seeing more sales.

Many distributors and manufacturers believe they could have actually sold significantly more machines than they did if only they had availability. Many also say they are already sold out for 2022.

This has informed Off-Highway Research’s forecast for modest growth in 2022 up to what appears to be the practical limit of supply at around 205,000 units. The European market is expected to fall back after that but, with extensive stimulus plans in place in the region on top of an already healthy pipeline of infrastructure work, sales are expected to stay at a high level.

Positive signs for the North American construction industry

Likewise in North America, after only a modest decline in 2020, equipment volumes shot to a record high in 2021 as the booming residential building market stimulated unprecedented demand for compact machines.

With the industry now braced for a series of interest rate rises in 2022, residential activity may slow. However, with the signing into law of President Biden’s US$1.2 trillion infrastructure bill in November, the positives outweigh the negatives for the region’s construction industry.

Sales of wheeled loaders account for approximately 15% of global equipment sales (Photo: Off-Highway Research)

Sales of wheeled loaders account for approximately 15% of global equipment sales (Photo: Off-Highway Research)

The bill will give contractors and rental companies greater certainty over the pipeline of work, providing confidence to invest in new machines. Construction equipment sales are expected to rise over the next two years as a result, taking the market to new record levels.

The general atmosphere for the infrastructure development in India is conducive for growth. However, there are various challenges on the horizon. Infrastructure projects have long gestation periods, and apart from planning and execution issues, legal and procedural problems may arise during the construction phase.

Based on all the foreseeable factors at the moment, the Indian construction equipment market is expected to follow an upward trend in the next five years, albeit with some disruption in 2024 due to the general election.

In Japan, the high of 68,000 machines sold in 2021 looks likely to be the peak point in the market for the time being. However, it should be stressed that the Japanese equipment market does not experience (or suffer from) cycles in the same way most other markets do. Demand tends to remain stable year-on-year, usually changing only by a few percentage points.

This is essentially the outlook for Japan going into the mid-2020s, with annual sales of equipment holding steady between 63,000-65,000 units per year.

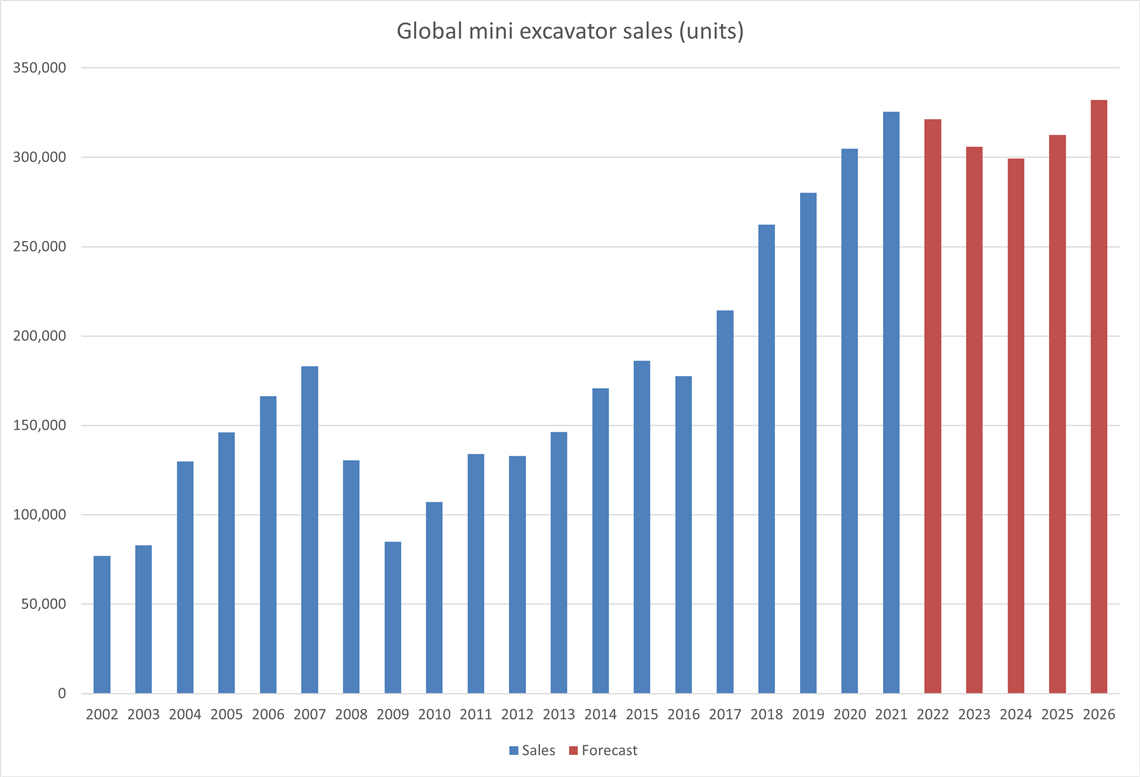

Global mini excavator sales since 2002 (Photo: Off-Highway Research)

Global mini excavator sales since 2002 (Photo: Off-Highway Research)

Commodity prices key to growth

For the rest of the world, the boom in commodity prices was the main driver of growth in 2021, with many countries seeing the highest sales since the early 2010s. The biggest emerging markets tend to be commodity producers; equipment sales rise and fall depending on demand for materials and pricing.

Rising commodity prices give producing companies the confidence to renew or expand their fleets. In many countries the major producers are state-owned, so to some extent high commodity prices are essential for investment in order to balance public finances. By the same logic, falling commodity prices tend to lead to falls in equipment sales and these cycles tend to be among the more volatile seen around the world.

While most markets will grow next year, their improvements will not be enough to offset the fall in demand in China, the world’s largest market for equipment sales. As a result, global construction equipment sales are forecast to fall 5% this year, with a similar decline in 2023. However, it is worth reiterating that, after 2021’s record high, this would still make 2022 the second-best year on record.

Sales of larger equipment to increase

Beyond 2022, the forecast is for continued high equipment sales worldwide, with a soft landing from the peak of 2021. This is broadly based on the premise that residential markets will remain buoyant, driven in part by ultra-low interest rates, while stimulus spending around the world will be a trigger for sales of larger equipment.

However, there are risks to the forecast, almost entirely on the downside. Inflation had been an issue throughout 2021 and having come to the conclusion that it was permanent rather than fleeting, central banks around the world have started to raise interest rates, and signal that further frequent increases can be expected throughout 2022.

Interest rates have been low ever since 2008 and the aftermath of the global financial crisis. The events of the last 12 months signal a fundamental change to that state. Inflation and scarcity are serious problems now, arguably for the first time since the 1990s. With that will come an end to the era of cheap money, which has lasted for more than a decade.

These issues were heightened by Russia’s invasion of Ukraine. The resulting economic sanctions against Russia are designed to stop it from funding its aggression by selling commodities. An unfortunate consequence of this is that because Russia is such a significant producer of oil, gas, metals and grain among others, that already high commodity prices have rocketed.

A positive is that this dynamic encourages other commodities producers to increase their output to lessen the crisis and benefit from selling at higher prices, and that of course requires construction and mining equipment. However, the heightened inflationary pressures are a bigger problem than the upside of this unlooked-for commodities boom.

The construction industry is proving resilient in the face of problems with supply chains, rising material costs and a shortage of workers (Photo: AdobeStock)

The construction industry is proving resilient in the face of problems with supply chains, rising material costs and a shortage of workers (Photo: AdobeStock)

A further threat is the very high population of young construction equipment machines which are now active around the world.

Annual sales to exceed one million units

There have only been two previous peaks when global equipment sales exceeded one million units – just prior to the global financial crisis when the market overheated and then again in the early 2010s, driven by stimulus in China. In both cases, annual sales of more than one million units of equipment were only sustained for one year – 2007 and 2010.

It is likely that 2022 will be the fifth consecutive year of annual sales in excess of one million units. When a slowdown in activity comes, excess young equipment in fleets around the world could be a barrier to new machine sales, exacerbating the slowdown for the industry.

Whether and to what extent this transpires remains to be seen. It comes down to the policy response of governments around the world to the most serious inflationary spike for three decades – a problem none of this generation of policy makers will have faced before – combined with their response to the most egregious act of naked aggression seen in Europe since 1939. Forecasting is a challenge at the best of times, but even more so when in uncharted territory.

Off-Highway Research is the worlds’s leading provider of market intelligence and forecasts for the global construction equipment industry. With offices in the UK, China, India, the US and Japan, it offers unrivalled market insights, helping its clients to see their global strategies, and plan and invest for profitable growth.

For more information, please visit: https://offhighwayresearch.com/

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM