Construction productivity: What we can learn from the Netherlands

26 May 2023

Productivity is a perennial problem for major construction markets all over the world.

But some markets – notably the Netherlands – have managed to buck the trend.

Poor labour productivity means that construction workers produce less in the same number of hours than their counterparts in more efficient sectors like manufacturing. That means that construction requires more labour resources than it otherwise would if it were more efficient, which means that projects end up costing more.

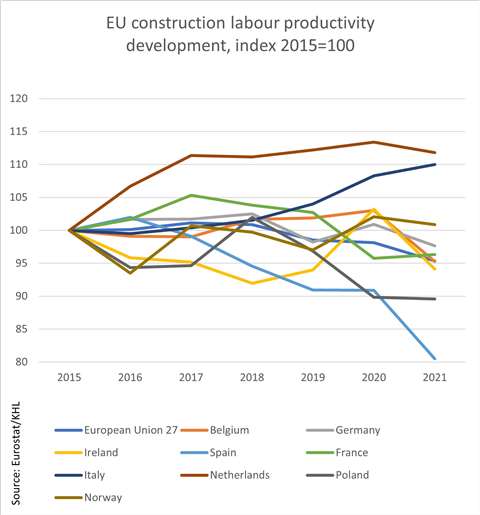

Labour productivity across the EU27 nations as a whole has fallen by 4.6% since 2015 (see chart). In certain markets, the decline is even more pronounced. In Spain, for example, it has dropped by 19.5%, while in Poland it is down by 10.4%. But Belgium enjoyed a 3% increase in productivity, at least until 2020. Meanwhile the Netherlands has seen a stronger 11.8% rise, although it has started to tail off slightly recently.

So how did the Netherlands manage to buck the productivity trend? And what can construction markets elsewhere in the world learn from it?

Necessity the mother of invention

One of the main reasons for the Netherlands’ increase in labour productivity was necessity. Between 1995 and 2001, Dutch construction volume rose by 33%, even as it declined 2% across the EU over the same period.

A housing boom meant that as of 2018, 40% of construction businesses were reporting a staff shortage. That was the highest of all sectors of the Dutch economy, with 25% of businesses overall reporting a shortage. Such a severe shortage helped to promote structural change to boost productivity.

Maurice van Sante, principal economist construction, at Dutch bank ING, explains, “High growth rates foster investments in new technologies and companies more willing and able to invest in new machines, robots and digitalisation. Production growth also results in more optimal deployment of employees as there is a lesser chance of overcapacity.”

Analysis by ING shows that the Netherlands has one of the highest numbers of robots in construction, at 1.5 per 10,000 workers. That compares to 1.2 across the EU12, 0.8 in Germany, 0.3 in the UK, 0.2 in the US and just 0.1 in China.

New technology and open standards

The Netherlands places orders for construction projects to the value of around €3 billion a year and is one of the leaders in BIM implementation in the EU. The country is one of only a handful in the EU with a mandate for open BIM standards (such as IFC, CB-NL and ETIM). Open standards mean that stakeholders in construction projects can break down silos and work more efficiently together.

The market has also seen the enthusiastic adoption of technology like augmented reality (AR) to make the construction process more efficient. For example, Dutch construction firm Ballast Nedam uses AR for ‘pre pour inspections’, comparing its 3D designs to the situation on the ground so that it can detect discrepancies ahead of construction. The company has also just launched its own bricklaying robot which it claims can reduce mortar consumption by 30% to 50%.

The world’s first 3D-printed steel bridge opened in Amsterdam in 2021. Dutch start-up MX3D used the project to showcase the potential of its multi-axis additive manufacturing technology, with the help of structural engineer Arup, while Autodesk assisted with digital production tools.

MX3D’s 3D printed bridge at Dutch Design Week in Eindhoven (Image: IIVQ / Tijmen Stam, CC BY-SA 4.0 via Wikimedia Commons)

MX3D’s 3D printed bridge at Dutch Design Week in Eindhoven (Image: IIVQ / Tijmen Stam, CC BY-SA 4.0 via Wikimedia Commons)

Skilled workforce

The Netherlands has the largest share of inhabitants proficient in using computers, software and the internet in Europe, with high participation levels in vocational learning as well as academic education. The country sits 6th in the INSEAD business school’s list of the Most Talent Competitive Countries 2022. Last year, the country bolstered its funding to upskill or retrain employees through the newly created STAP budget. It offers €1,000 in funding for training to people in the Netherlands regardless of their employment status. The initiative has been designed to reflect rapid changes in working practices. The government said, “Work changes quickly. More and more work is digital.” It highlighted the fact that some sectors face serious shortages, while other positions no longer exist after the coronavirus pandemic.

What limits productivity?

Why does construction suffer from poor productivity? The reasons vary but some of the chief causes are:

- Shifting production locations: Unlike manufacturers, who can set up a production facility on a permanent site to serve their market, construction companies see their production location shift each time, requiring the movement of materials, heavy machinery and workforces. Efforts to manufacture building elements offsite could prove to be part of the solution to this.

- Bespoke designs: Construction companies generally have to build structures and buildings according to custom designs produced by an architect that have to comply with local regulations and requirements.

- Volatile demand: Fluctuating demand for construction projects means that companies need to remain flexible, which can deter them from making investments in large fixed costs.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM