Construction equipment trade review 2021

16 March 2022

The CEA’s expert analyst, Paul Lyons, examines the UK’s construction equipment imports and exports for 2021, using HMRC official trade statistics data. The market report covers construction and earth moving equipment but excludes separate trade data for components and parts.

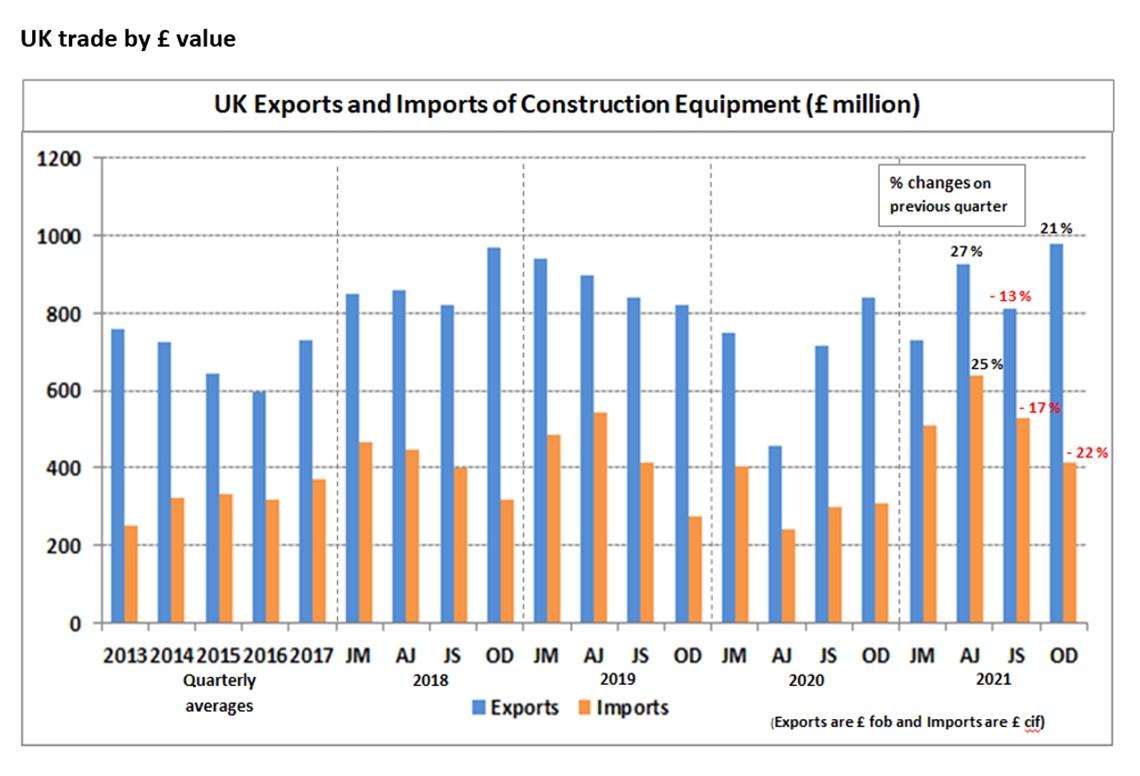

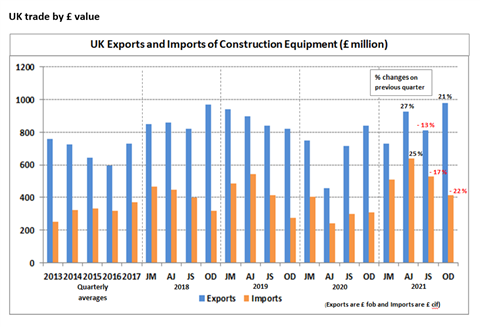

In the last quarter of 2021, imports and exports of construction and earthmoving equipment showed very different outcomes.

(Image: CEA)

(Image: CEA)

Exports showed a significant increase of 21% on Q3 levels and reached a similar level to Q4 2018, which was a “record” quarterly level since trade has been monitored from 2013.

As a result, exports for the whole of 2021 were 25% above 2020 levels at £3,442 million, which was very similar to the high levels reached in 2019.

In contrast, imports of equipment in Q4 showed a 22% fall on Q3 levels, continuing to fall after reaching peak levels in Q2.

However, despite the declines seen in the last two quarters, total imports in 2021 were still 67% up on 2020 levels, reaching £2,092 million.

This was above the level of imports seen in 2019, which was the highest year since trade has been monitored from 2013.

This is consistent with the high level of equipment sales in the UK in 2021, which ended up above the peak levels seen in 2018 and 2019, and were the highest since before the “financial crash” in 2007.

Exports of equipment in Q4 were £977 million, similar to the peak levels in Q4 2018, as highlighted above. An update on total tonnages shipped in 2021 still isn’t available for this report due to problems with some of the tonnage data in Q3, which haven’t been corrected yet.

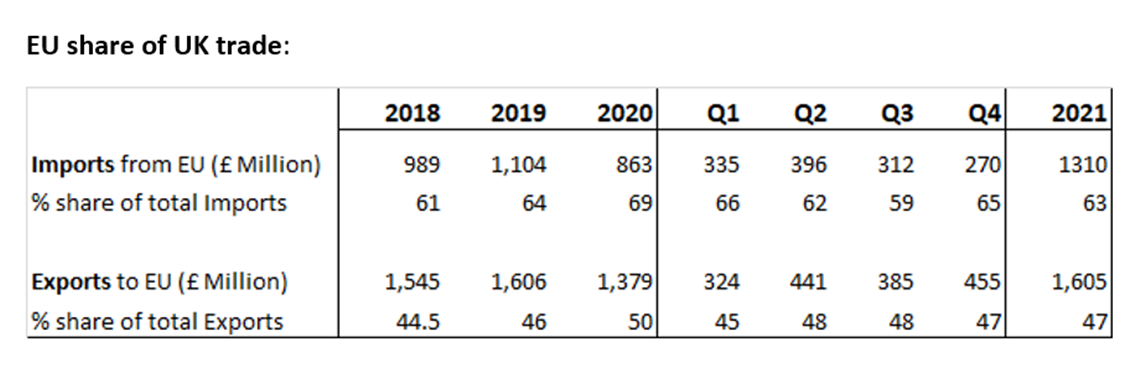

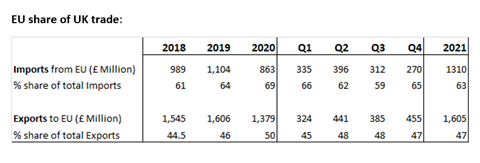

On a £ value basis, while exports of equipment were at very high levels last year, the share of exports to the EU has remained at slightly lower levels in 2021 compared with 2020.

Exports to the EU accounted for 50% of total exports in 2020, but fell to 47% in 2021, which was similar to 2019 levels.

After EU share of exports had shown a growing trend in earlier years, the reduced levels in 2021 could be attributed to a post Brexit effect.

Imports in Q4 were £413 million, 22% down on Q3 levels, and the lowest quarterly level since 2020. On a tonnage shipped basis, they were just above 77,000 tonnes in Q4, which was also a reduction of 22% on Q3 levels of trade.

Full year construction equipment trade 2021

However, for the whole of 2021, imports were 67% up on 2020 levels at 396,000 tonnes, due mainly to the high levels in the first half of the year.

(Image: CEA)

(Image: CEA)

Despite total imports of equipment reaching “record” levels in 2021, imports from the EU showed a reduction.

The EU share of total imports fell to 63% last year compared with 69% in 2020. This reduced share of imports from the EU can probably be attributed to a post Brexit effect.

As highlighted above, higher levels of imports in 2021 overall, is consistent with the latest statistics on UK sales of equipment, as reported by Systematics International from the construction equipment data exchange.

This identifies that unit sales in 2021 were 48% above 2020 levels, which suffered from the impact of lockdown in the construction industry in the early part of the year.

However, the reduction in imports of equipment in the second half of the year may have been influenced by some of the supply chain constraints experienced around the world, which included freight and shipping problems.

The UK remained a net exporter of construction and earthmoving equipment in 2021, with exports (£3,442 million) 64% higher than imports (£2,092 million).

However, this was a much smaller margin than previous years - for example in 2020, exports were more than double the level of imports.

In both cases, this shows modest increases in the annual share for EU countries in earlier years, but as highlighted above, after peaking in 2020, both types of trade returned to similar levels as 2019 last year:

Exports of equipment by country of destination. Click to enlarge. (Image: CEA)

Exports of equipment by country of destination. Click to enlarge. (Image: CEA)

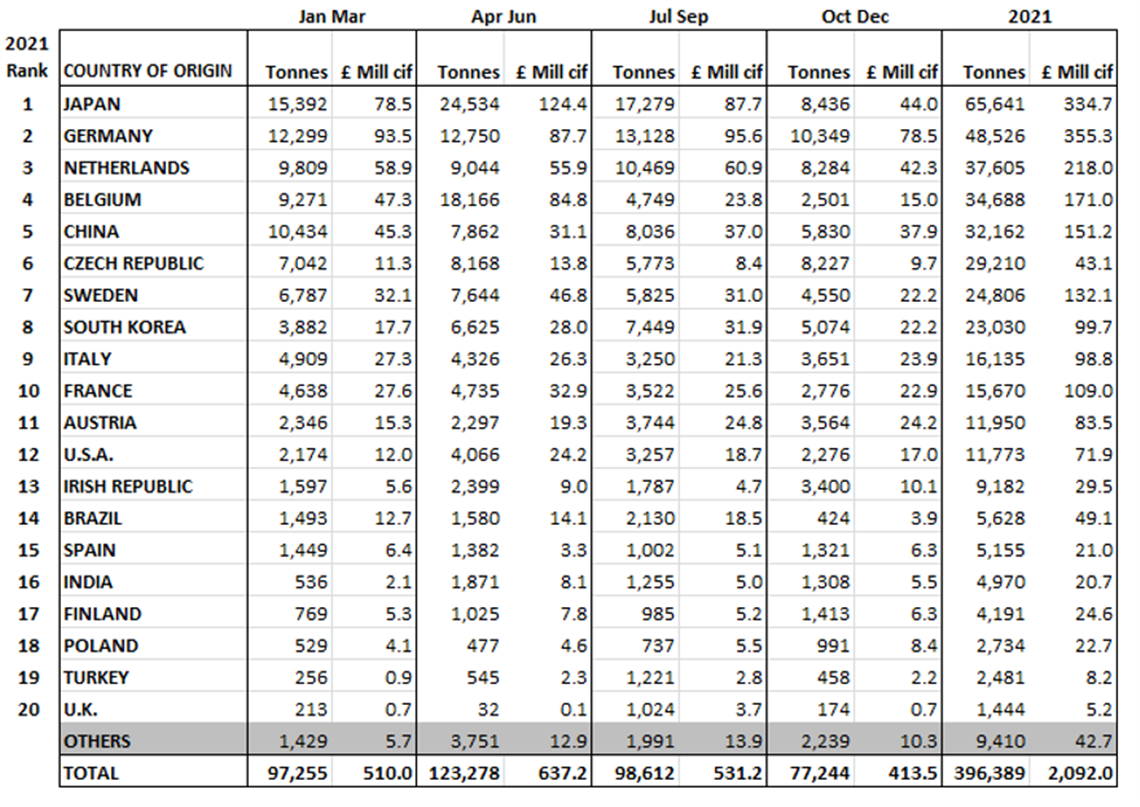

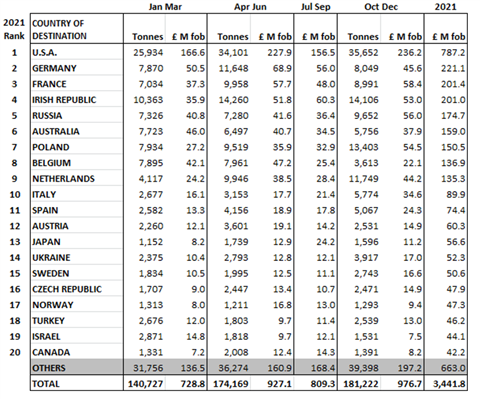

Exports of Equipment by Country of destination

In 2021, UK exports of equipment were shipped to over 170 different countries. The table to the right shows rankings for the Top 20 countries based on weight of machines shipped (tonnes) since 2019.

However, for 2021, the country ranking has been switched to a £ value basis due to the problem with tonnage shipped data from customs highlighted above.

In 2021, the Top 20 countries accounted for just over 80% of total exports in value terms.

The USA remained the top destination for UK exports during 2021. Its share of total exports compared with 2020 levels has remained fairly stable at between 22% and 23%.

The destination country showing the strongest growth for exports during 2021 was Russia. This market saw an increase in shipments of 68% in 2021 to reach just under £175 million, accounting for over 5% of total UK exports of equipment.

This resulted in Russia climbing to 5th place in the league table of destinations. Following the recent invasion of the Ukraine and the potential imposition of sanctions, this has been flagged up as a potential issue for UK exporters.

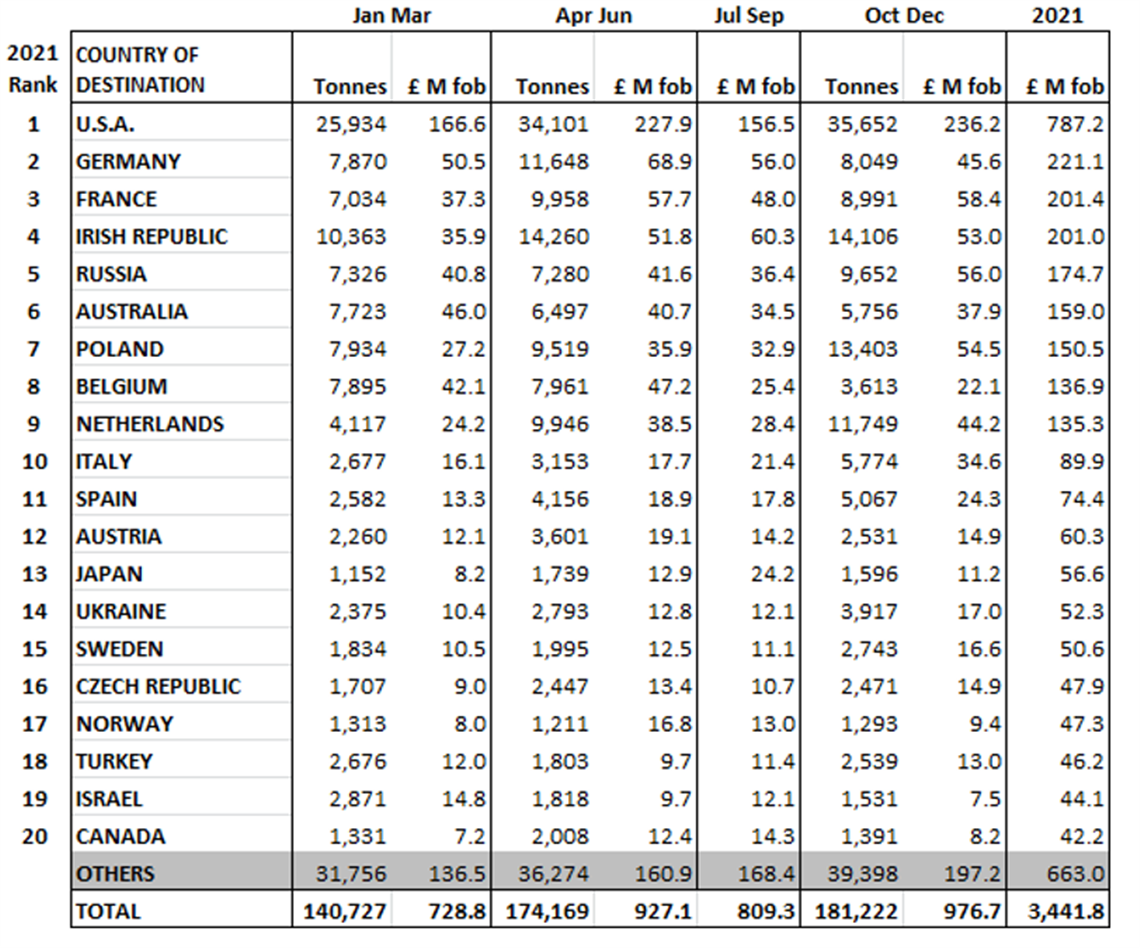

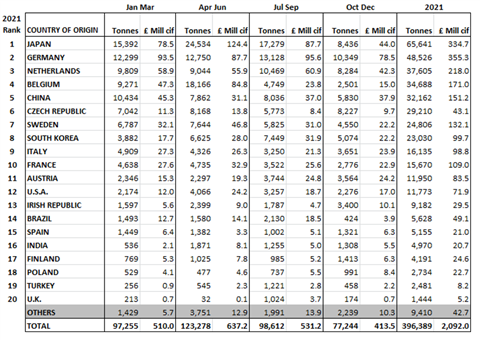

Imports of Equipment by Country of origin

In 2021, UK imports of construction and earthmoving equipment arrived from over 50 different countries. The table below shows rankings for the Top 20 importing countries based on weight (tonnes) of machines since 2019.

Imports of equipment by country of origin. Click to enlarge. (Image: CEA)

Imports of equipment by country of origin. Click to enlarge. (Image: CEA)

The Top 20 countries accounted for over 97% of total imports in both weight and value terms in the first nine months of the year.

Similar to previous years, Japan has remained as the leading source for UK imports in 2021.

Its share on both a £ value and tonnage shipped basis remained stable last year at around 16%.

Germany remains as the second highest source of imports of equipment into the UK on a tonnage shipped basis, but was actually above Japan on a £ value basis.

Between them Japan and Germany account for nearly a third of total imports.

Imports from China have continued to increase their share of total imports and accounted for over 8% in 2021 on a tonnage shipped basis. This moved China up to 5th place in the country ranking for 2021.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM