How infrastructure spending can boost the 2022 global crane market

25 February 2022

Global mobile crane sales did not have the most convincing rebound in 2021 but could start to do better as infrastructure spending picks up. Chris Sleight reports

In global terms, the market for mobile cranes has never been higher. In the region of 65,000 all terrain, lattice boom crawler, rough terrain and truck cranes were sold in 2021, a modest increase on 2020, but about a three-fold increase on 2016, the low point in the market worldwide.

As ever, the distorting effect of China has to be considered. Mobile crane sales in China last year were of the order of 56,000 machines – a record volume, mostly fairly small truck cranes, but including around 2,000 lattice boom crawlers. The market in China is believed to have passed its peak and is expected to fall away over the next two to four years to more sustainable, but still impressive, levels of around 30,000 units a year.

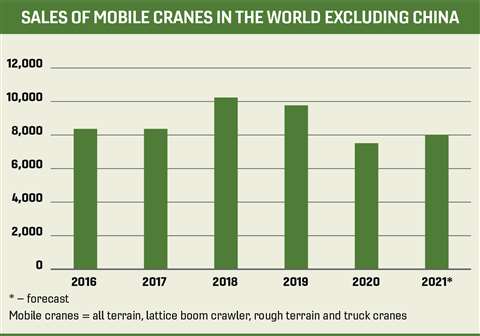

Sales of mobile cranes in the world excluding China

Sales of mobile cranes in the world excluding China

In the world excluding China, the market for mobile cranes generally varies between 8,000 and 10,5000 machines a year, although in 2020 it was of course abnormally low at 7,500 machines sold.

The Covid pandemic of 2020 had a significant impact on global crane sales. In China, huge stimulus spending meant the market went to a new, unprecedented high. In the world excluding China, however, total crane sales fell by 24 per cent. This was a much steeper decline than was seen in the broader markets for earthmoving equipment, which was down 12 per cent in the world excluding China in 2020.

Although there was a rebound in 2021, the recovery of crane sales did not look as robust as that of the wider construction equipment markets, which surpassed the previous sales record set in 2018 despite struggling with component supply, shipping and logistics issues.

While there was an improvement in the mobile crane segment, it did not look as robust or as convincing. The main gauge of this as 2021 progressed were financial results from the few crane manufacturers which are stock market listed. These pointed to only about a 5-10 % increase in revenues compared to 2020, and an industry which was struggling to make much of a margin.

The fortunes of the different crane types depend to a certain extent on the dynamics in the markets where they are most popular. For example, although all terrain cranes are fairly universally popular, when China is excluded around half the global demand for these machines is in Europe. Similarly, around half of the world’s rough terrain crane demand is in Japan, although North America is also a significant market. Crawler and truck-mounted crane demand outside China tends to rest particularly on the dynamics in developing Asian markets, particularly southeast Asia.

Although crane sales looked slow to recover in 2021, this is not necessarily an indicator of a deep-seated problem. The boom in construction equipment sales in the second half of 2020 and throughout 2021 was largely compact machines (under 10 tonnes operating weight), which were linked to strong residential construction markets. By their nature these are relatively high volume, low value, machines – they flatter the unit sales figures.

Sales of larger construction machines, including mobile cranes, can be expected to take longer to recover. In times of uncertainty and economic stress, it is the larger purchases which are the first to be cancelled. Demand, however, should recover and could become very strong as post-pandemic stimulus spending and infrastructure projects come on stream.

About the author

Chris Sleight is managing director at Off-Highway Research, a market research and forecasting company specialising in international construction equipment markets. Among its latest studies is Global Mobile Crane Fleets, a report produced in conjunction with ICST, analysing the composition, growth and development of the world’s 100 largest crane-owning companies. |

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM